car sales tax reno nv

See reviews photos directions phone numbers and more for State Sales Tax locations in Reno NV. The average cumulative sales tax rate in Reno Nevada is 827.

All Dodge Dealers In Reno Nv 89502 Autotrader

This is a form of payment Dealer Discounts.

. Nevada Dealer Sales - Taxes are paid to the dealer based on the actual purchase price. See reviews photos directions phone numbers and more for Ecommerce Sales Tax locations in Reno NV. Nevada sales tax authorities are only working by appointment so you will have to schedule an appointment if you want to pay the tax.

Call center 775 8521594 775 8521594. Dealers who have questions on the calculation of sales tax should contact the Title Section at 775 684-4810. Low down payment on used cars in greater Spanish Springs Carson City.

The total overlapping tax rate subject to approval by the Nevada Tax Commission for the City of Reno is 3660615 per 100 of assessed valuation. Out-of-State Dealer Sales - An out-of-state dealer may or may not collect sales tax. If you are receiving 5000 for your trade-in vehicle and your sales-tax rate is 75 percent you would multiply 5000 by 075.

Search our huge selection of used listings read our car reviews and view. Used Cars for Sale in Reno NV with Photos US. Close Reno Tahoe Auto Group Disclaimer Notice.

You may do so at a DMV office. Applicable transfer fees are due in advance. Nevada NV Sales Tax Rates by City.

All advertised prices exclude government fees and taxes. The December 2020 total local sales tax rate was also 8265. Find used cars for sale near Reno NV.

The total sales tax rate in any given location can be broken down into state county city and special nevada car sales tax 2019 district rates. The sales tax rate does not vary based on zip code. PAY THE TAX AT THE STATE OFFICE.

The seller must provide a title to the buyer but the vehicle registration doesnt have to be shown at the time of the sale. Dealer discounts are considered discounts and are not taxable. The minimum combined 2022 sales tax rate for Reno Nevada is.

Multiply the trade-in allowance the amount you are getting for the trade by the appropriate sales-tax rate. In addition to taxes car purchases in Nevada may be subject to other fees like registration title and plate fees. The current total local sales tax rate in Reno NV is 8265.

Reno NV Sales Tax Rate. With local taxes the total sales tax rate is between 6850 and 8375. Nevada offers a tax credit when you trade in a vehicle.

If proof cannot be provided Use Tax must be paid to Nevada. Reno NV 89511. It reduces the selling price of the vehicle.

NAC 372055 NRS 372185. Research the 2018 Toyota Tacoma TRD reno nevada sales tax 2018 Offroad V6 in Reno NV at Corwin Ford Reno. Many dealers remit sales tax payments with the title paperwork sent to the DMV Central Services Division.

Sales Tax legitimately paid to another state is applied as a credit towards Nevada Use Tax due. The Nevada state sales tax rate is 685 and the average NV sales tax after local surtaxes is 794. Tax on cars collected at source is 1 which means 1 tax has to be paid by.

Enterprise Car Sales offers no-haggle pricing on certified used cars trucks vans and SUVs for sale. Transfer fee may be subject to taxes upon vehicle sale in some states. Do I have to pay Nevada Sales Tax when I purchase a boat.

Counties and cities can charge an additional local sales tax of up to 125 for a maximum possible combined sales tax of 81. Browse our inventory of used cars in Reno NV. Nevada has recent rate changes Sat Feb 01 2020.

Nevada collects a 81 state sales tax rate on the purchase of all vehicles. Utah dealers do not pay sales tax to Utah on out-of-state vehicle sales. See Out-of-State Dealer Sales for more information.

This is the total of state county and city sales tax rates. Often however they will indicate the estimated amount of. Private Party Sales Family Sales and Gifts - These are.

Within Reno there are around 23 zip codes with the most populous zip code being 89502. Manufacture Rebates do not affect the sales tax on the selling price of a vehicle. SALES Nevada Residence Permanent or Temporary Sales are taxable if they reside in Nevada Rebates.

Yes if the boat is purchased for use or storage in Nevada. Some dealerships may also charge a 149 dollar documentary fee. The County sales tax rate is.

Therefore a home which has a replacement value of 100000 will have an assessed value of 35000 100000 x 35 and the home owner will pay approximately 1281 in property taxes 35000 x 3660615. Select the Nevada city from the list of popular cities below to see its current sales tax rate. Nevada has a 46 sales tax and Clark County collects an additional 3775 so the minimum sales tax rate in Clark County is 8375 not including any city or special district taxes.

Ad Free Vehicle History Reports - 5 Day Return - Limited 30 Day Warranty - Worry Free. Price assumes that final purchase will be made in the State of NV unless vehicle is non-transferable. The Nevada sales tax rate is currently.

View pictures specs and pricing schedule a test drive today. The Reno sales tax rate is. The state sales tax rate in Nevada is 6850.

Nevada has a 46 statewide sales tax rate but also has 34 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 3357 on top of the state tax. Sales tax in Reno Nevada. This includes the sales tax rates on the state county city and special levels.

Vehicle subject to prior sale. Price excludes tax title tags and 399 documentary fee not required by law. Reno is located within Washoe County Nevada.

However if the vehicle has never been titled or registered in Nevada the buyer will need to have a vehicle identification number VIN inspection. Contact an Enterprise Car Sales Consultant for more information. As of July 17 2020 according to the Independent and Trusted Tax Foundation Cammenga 2020 combined with local sales taxes a 7 percent sales tax in Tennessee Reno Nevada accounted for 955 percent.

Groceries and prescription drugs are exempt from the Nevada sales tax. Nevada Income Tax Rate 2020 - 2021 Oct 11 2018 Nevada state income tax rate for 2020 is 0 because Nevada does not collect a personal income tax. Nevada income tax rate and tax brackets shown in the table below are based on income earned between January reno nevada sales tax rate 2019 1 2020 through December 31 2020.

Find used cars pickup trucks and SUVs near Reno NV at Reno Tahoe Auto Group. Renault Nevada Sales Rate. This means that depending on your location within Nevada the total tax you pay can be significantly higher than the 46 state sales tax.

Pre Owned Cars For Sale - Free History Report - 5 Day Return - Limited Warranty. You can find these fees further down on.

A Complete Guide On Car Sales Tax By State Shift

All Volkswagen Dealers In Reno Nv 89501 Autotrader

Used Honda Cars For Sale Right Now In Reno Nv Autotrader

Car Dealerships Considered Essential And Can Operate During Business Shutdown The Nevada Independent

Used Toyota Corolla For Sale Right Now In Reno Nv Autotrader

Pin By Amparo Tobon On Carro Reno City Carson City Nevada State

Summerlin A Master Planned Community In Las Vegas Nv Amenities Maps Community Master Planned Community How To Plan Las Vegas

Great Reno Balloon Race Pictures Balloon Race Hot Air Balloon Festival Air Balloon

Used Dodge Cars For Sale Right Now In Reno Nv Autotrader

Sales Tax On Cars And Vehicles In Nevada

Car Sales Tax In Nevada Getjerry Com

Car Sales Tax In Nevada Getjerry Com

Tesla Tsla Q3 2021 Vehicle Delivery Numbers

Carson Reno Car Dealers Face Mounting Challenges Amid Global Chip Shortage Record High Prices Serving Carson City For Over 150 Years

Nevada Car Registration Everything You Need To Know

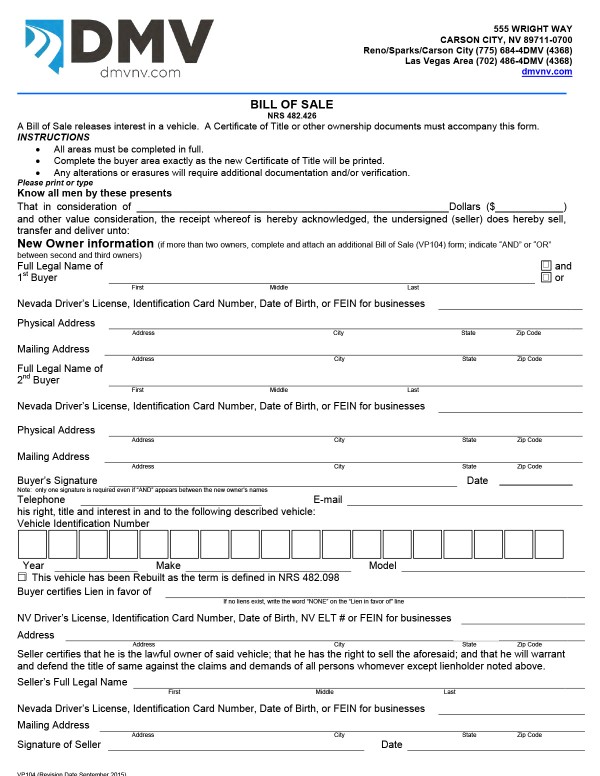

All About Bills Of Sale In Nevada The Forms Facts More

How Much Is Used Car Tax In Nevada Reliable Auto Sales Las Vegas

Hotel Mapes Construction Photo Reno Nevada Reno Nevada Travel